At Summit, Energy Executives Outline Arkansas’ Potential and the Work Ahead

In This Edition:

More than 800 people packed the Statehouse Convention Center in Little Rock for the second Arkansas Lithium Innovation Summit. Lithium Link was at every keynote and mainstage panel, talking to key players and learning about the industry’s next steps in Arkansas.

At the Arkansas Lithium Innovation Summit, executives from ExxonMobil, Chevron, Standard Lithium and Equinor say the state has what it takes to become a U.S. lithium hub.

The Arkansas Economic Development Commission’s top executive sits down with Lithium Link’s Lance Turner to talk about the rise of DLE and what’s changed since last year’s summit.

A new report analyzes the way the lithium industry could grow in Arkansas and ponders whether DLE could be the state’s “golden goose.”

Let’s dive in!

Arkansas Emerges as a U.S. Lithium Hub — But the Scale-Up Challenge Is Real

Executives from some of the top energy companies active in the Smackover Formation in Arkansas laid out how the state is positioning itself for large-scale lithium production and what remains to be solved.

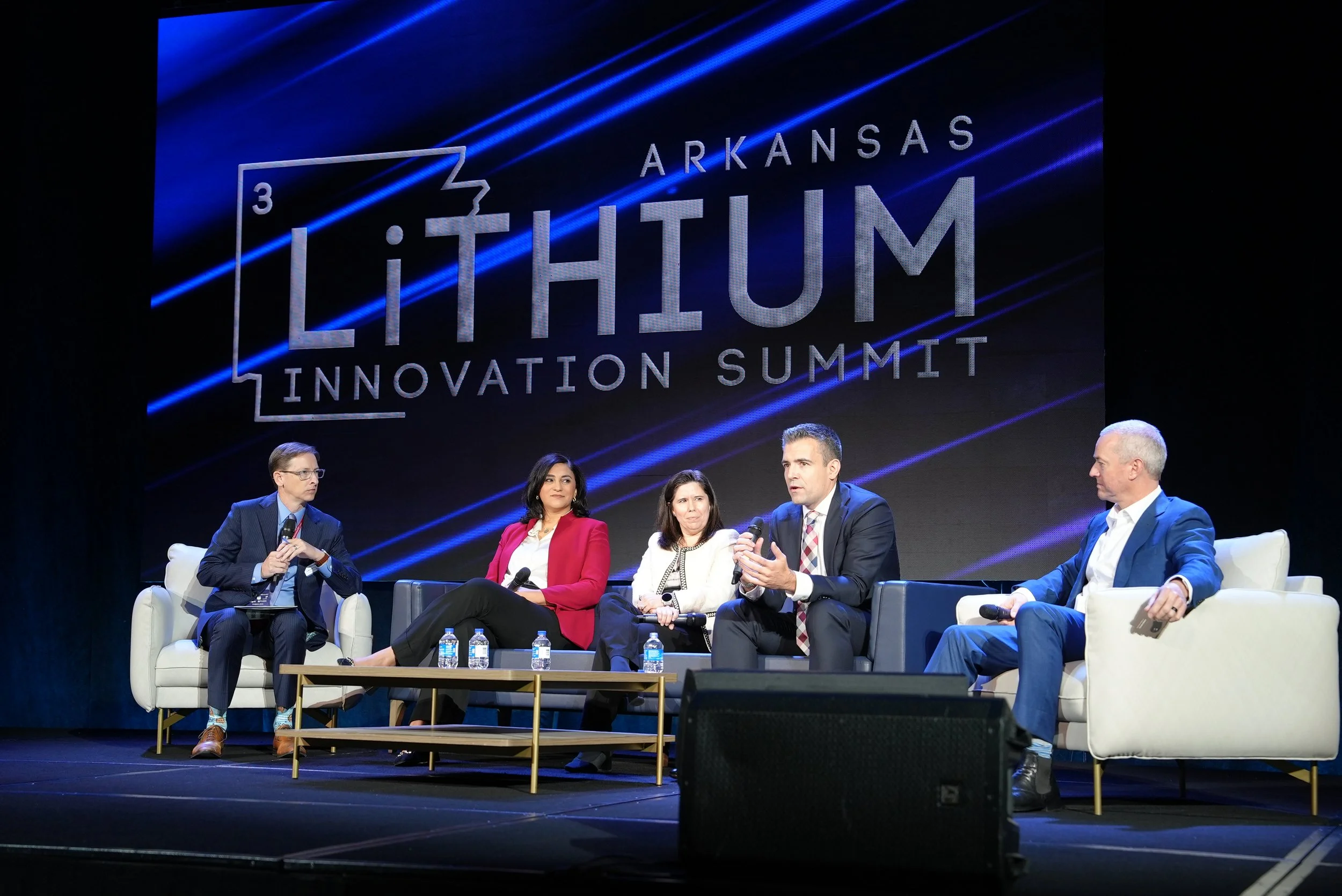

Executives from ExxonMobil, Chevron, Standard Lithium Ltd. and Equinor took the stage Oct. 28 at the second Arkansas Lithium Innovation Summit in Little Rock.

The four of them — Patrick Howarth, lithium global business director, ExxonMobil; Kristen Ghattas, vice president of carbon capture and storage lithium, Chevron; Andy Robinson, president and COO, Standard Lithium; and Allie Kennedy Thurmond, vice president, North American lithium, Equinor — spoke for an hour as part of a panel moderated by Lithium Link Editor Lance Turner on the first morning of the two-day summit.

During the discussion, the executives emphasized Arkansas’ potential and the work ahead. Howarth said the company’s growing acreage — expanding from 100,000 to 300,000 net acres — marks a commitment to “building not just one project, but multiple projects to scale the resource.”

“What we’re all trying to do is make Arkansas as competitive as it possibly can be,” Howarth said.

Robinson said: “We spend a lot of time persuading people outside of Arkansas this is real… that it can become a credible supply of lithium chemicals for North America for decades to come.”

The panel’s tone: optimistic about the prize, candid about the risks.

(From left to right:) Lance Turner of Lithium Link, Kristen Ghattas of Chevron, Allie Kennedy Thurmond of Equinor, Patrick Howarth of ExxonMobil and Andy Robinson of Standard Lithium. Photo by Kaycee Kiser/AEDC.

Key takeaways:

Partnerships matter: Robinson called the Standard Lithium/Equinor collaboration — announced in early 2024 and now called Smackover Lithium — “transformational,” noting the last 18 months have been spent “gearing us up to now get to the start line.”

Regulatory/operational edge: Ghattas highlighted what drew Chevron to Arkansas: “The U.S. consumes about 12% of global lithium batteries but produces less than 1%. We saw an opportunity to help develop an industry that hasn’t yet been built here.”

Ghattas also cited Arkansas’ regulatory environment, which gives the state a “first-mover advantage.”

Global backdrop: The panel made no illusions: The U.S. is playing catch-up to China. As Robinson put it: “The will is there. The technology is there. We’re 10 years behind China. Let’s not kid anyone.”

Challenges

Panelists said that while Arkansas has what it takes — resource, workforce, regulatory framework — the commercial proof remains ahead. Key blocks: large-scale deployment of direct lithium extraction (DLE), cost control in a volatile market and securing downstream processing in the U.S.

Final Takeaway

In the end, panelists agreed that success in Arkansas will depend on building low-cost, large-scale projects supported by a stable regulatory environment and deep local partnerships.

They also emphasized that Arkansas’ cooperative approach — with government, industry and education leaders working in concert — could set the national model for how to responsibly develop domestic lithium.

Collaboration across state lines, they said, will also be essential for scaling infrastructure, technology and workforce programs to match the pace of global demand.

U.S. Rep. Bruce Westerman addresses more than 800 summit attendees on the first day of the summit. Photo by Kaycee Kiser/AEDC.

More Summit Coverage:

Gov. Sarah Huckabee Sanders, U.S. Rep. Bruce Westerman and Arkansas Commerce Secretary Hugh McDonald addressed more than 800 summit attendees on the gathering’s first day. See coverage from the Arkansas Democrat-Gazette, Reuters, Talk Business & Politics, Arkansas Times, Arkansas Money & Politics, KATV, KTLO and KHBS/KHOG.

Plus:

Lithium industry will require collaboration, communication, southern Arkansas officials say — Arkansas Democrat-Gazette

Arkansas’ potential as lithium production hub raises hopes of officials, residents — Arkansas Democrat-Gazette

Parting Shot:

Long-time Arkansas political reporter and columnist Steve Brawner attended the summit and shares his thoughts: “This may be the most important Arkansas business story since Sam Walton opened his first Walmart in Rogers in 1962.”

Clint O’Neal: AEDC Working to Build the Lithium Supply Chain in Arkansas

Clint O’Neal, executive director of the Arkansas Economic Development Commission, visited the Lithium Link booth at the Arkansas Lithium Innovation Summit for a quick conversation about what the emerging DLE industry means to the state.

Next Up: In the next edition of Lithium Link, watch our summit conversation with Sheryl Edwards, associate vice president of strategic initiatives and director of government relations for Southern Arkansas University in Magnolia, and executive director of Lithium Learns, a workforce and education initiative.

Report Analyzes the Economic Promise, Risk of Direct Lithium Extraction in Arkansas

A new Resources magazine analysis explores how direct lithium extraction (DLE) could reshape southwest Arkansas’ economy, potentially boosting county budgets and private incomes, but with major uncertainties about long-term returns.

With energy leaders identifying the Smackover Formation as a new hub for lithium extraction, the report by Resources for the Future (RFF) economists Beia Spiller, Frances Fitzgerald and Andrew Beach models how taxes and royalties might flow to landowners, counties and the state under various production and market scenarios.

“Given the increasing global demand for lithium, the region’s untapped wealth of the mineral could provide a powerful boost to the rural area’s local economy,” the economists write, “not just by expanding local employment and skills training, but also by providing tax revenues for state and local governments to support schools, roads, and other services.”

Here are four key findings from the report, titled “Direct Lithium Extraction in Arkansas: A Golden Goose for the State?”:

Local impact: Lafayette, Union and Columbia counties could expand their yearly budgets by around 15% from DLE-related tax revenues under expected conditions — but that benefit could fall to zero under unfavorable ones.

Landowner gains: Landowners are projected to collect nearly double the annual revenues counties would receive through taxes.

Volatile future: The analysis underscores DLE’s uncertainty. Lithium prices have fluctuated dramatically in recent years, and the technology has yet to be proven at commercial scale.

Royalty precedent: The report assumes a 2.5% royalty rate, following the Arkansas Oil and Gas Commission’s approval for Smackover Lithium’s South West Arkansas Project (and ExxonMobil’s Pine unit), likely setting a benchmark for future agreements.

Known Unknowns

The economists detail a series of risks that could affect long-term outcomes:

Technology risk: Whether extraction efficiency and operating costs will hold up outside of pilot plants “is yet to be seen.”

Market volatility: Lithium prices have swung dramatically over the past five years, reaching a multiyear low in 2025.

Optimistic assumptions: Company models rely on prices around $30,000 per tonne, but the report’s analysis uses a more conservative $21,000 per tonne forecast from SC Insights.

Operational uncertainty: While landowners would still earn over $3 million per year under the report’s worst-case scenario, counties could lose all revenue depending on tax assessments.

Inside:

The article includes detailed tables and figures that outline:

Taxes and royalties collected from DLE operations.

Average yearly revenues for landowners and governments.

Four revenue scenarios from “worst-case” (no extraction) to “lithium boom.”

Yearly revenues for state and county governments under each scenario.

Comparative breakdowns of state and county budgets, showing how DLE income could affect fiscal health.

The bottom line: The report says that DLE could deliver meaningful local and state revenues, but the scale depends on global lithium markets, extraction efficiency and policy. They also write that governments seeking reliable revenue might need to support the industry through stabilization measures, though such interventions could be costly.

Get More: Read the full Resources article for charts and data tables.